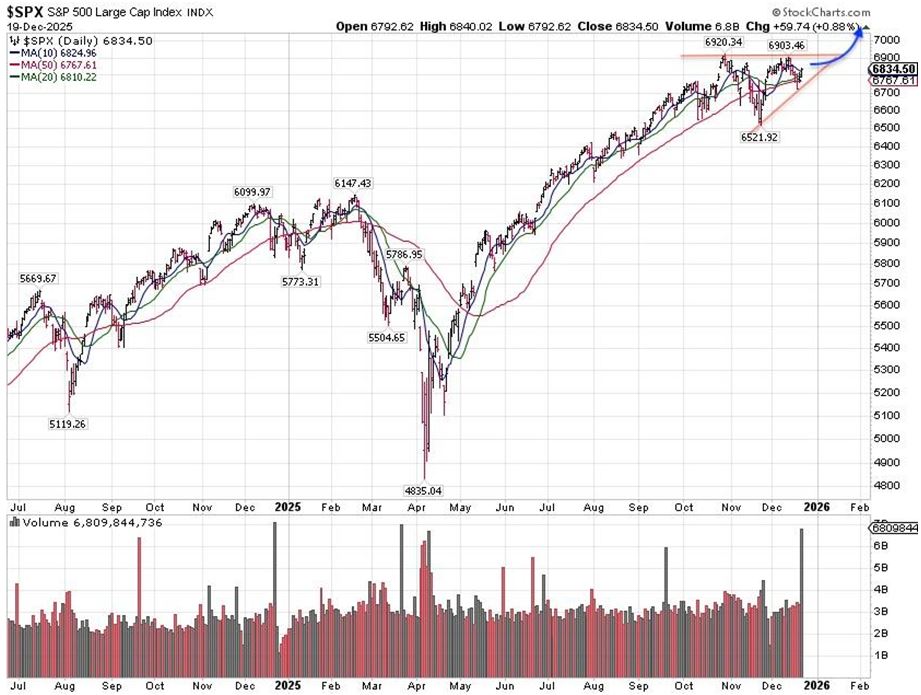

As 2025 draws to a close, Wall Street delivered a resilient performance in December, with major indexes hitting multiple record highs amid holiday-thin trading and a classic Santa Claus rally. The S&P 500 flirted with the 7,000 milestone, closing the year up nearly 18%, while the Nasdaq surged over 22% on continued AI enthusiasm. Despite some late-month pullbacks in tech megacaps, the market shook off earlier turbulence to end on a high note. Here’s a roundup of the top 10 developments that defined December, followed by key expectations for January 2026.

Top 10 Stock Market Highlights from December 2025

- S&P 500 and Dow Set Multiple Record Highs The benchmark S&P 500 repeatedly touched all-time highs, including intraday peaks near 6,945, driven by optimism over economic resilience and AI momentum.

- Santa Claus Rally Kicks In The traditional end-of-year boost materialized, with stocks rising in the last five trading days of December, setting a positive tone despite thin volumes.

- Precious Metals Surge to Records Gold and silver hit all-time highs, with silver briefly topping $80 per ounce before a sharp reversal, reflecting investor bets on inflation hedges.

- Tech Sector Leads Year-End Gains AI-related stocks, including Nvidia crossing $5 trillion in market cap earlier in the year, powered much of the rally, though megacaps saw profit-taking late in the month.

- Fed Minutes and Rate Outlook in Focus Attention turned to the release of December Fed meeting minutes, providing clues on potential pauses in rate cuts amid divided policymaker views.

- Strong Annual Performers Shine Standouts like Palantir, Robinhood (up nearly 222%), and gold miners dominated the S&P 500’s top gainers list for 2025.

- SoftBank’s Potential Acquisition of DigitalBridge Reports of advanced talks for SoftBank to buy the data center firm sent shares surging, highlighting continued M&A interest in infrastructure.

:max_bytes(150000):strip_icc()/bull-56a6fef75f9b58b7d0e5e60d.jpg)

- Market Breadth Improves Gains broadened beyond tech, with cyclicals like financials and industrials contributing to record closes.

- Holiday-Shortened Week Volatility Thin trading led to dips on December 29, with the Dow and S&P 500 slipping as investors trimmed positions.

- Global Indexes on Track for Double-Digit Gains Despite tariff concerns and geopolitical tensions, worldwide stocks posted strong 2025 returns, underscoring broad-based resilience.

What to Expect in January 2026

Looking ahead, analysts project cautious optimism for the new year. The Santa Claus rally often extends into early January, potentially boosting returns further. Earnings season kicks off mid-month with big banks reporting, while investors watch for Fed signals on rates—traders see an 80% chance of no change in January but possible cuts later if the labor market cools.

Broader forecasts point to solid, if moderated, gains: expectations for the S&P 500 range from 5-11% upside in 2026, fueled by earnings growth, AI expansion, and potential policy support. Risks include elevated valuations, sticky inflation, and policy shifts under the incoming administration. Small-caps and quality stocks may outperform as the bull market broadens.

Stay tuned to GLHRInvesting.com for real-time updates as markets navigate the transition into 2026.